does mississippi pay state taxes

Box 23050 Jackson MS 39225-3050. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or.

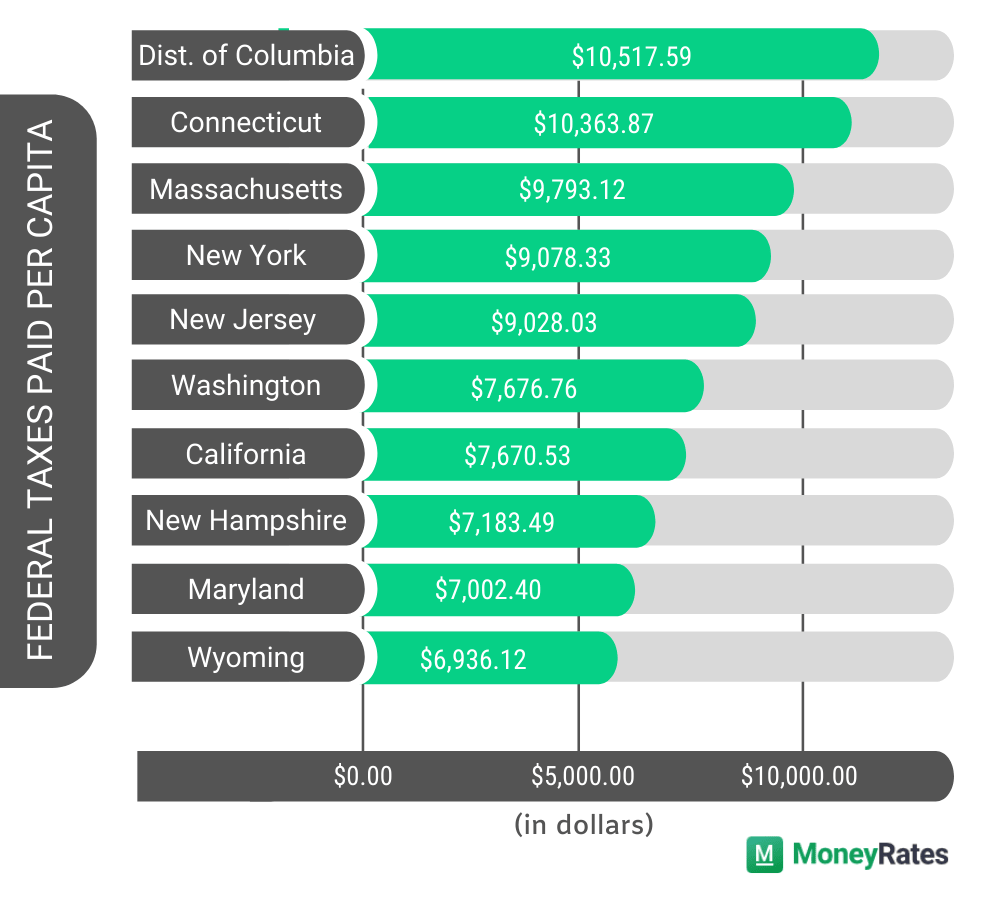

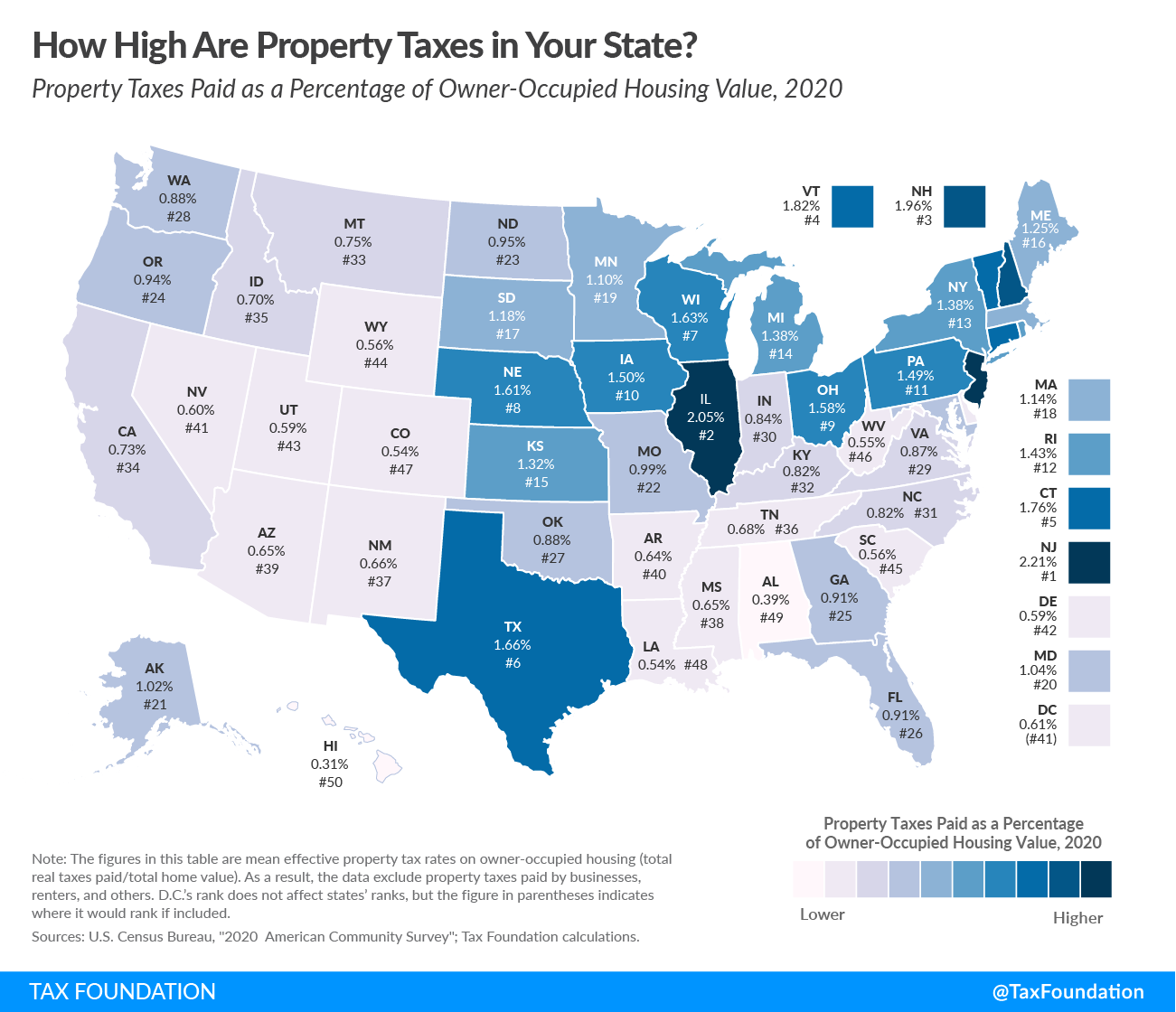

States With The Highest Lowest Tax Rates

Mississippi income tax rate.

. If you are receiving a refund PO. An instructional video is available on TAP. The graduated income tax rate is.

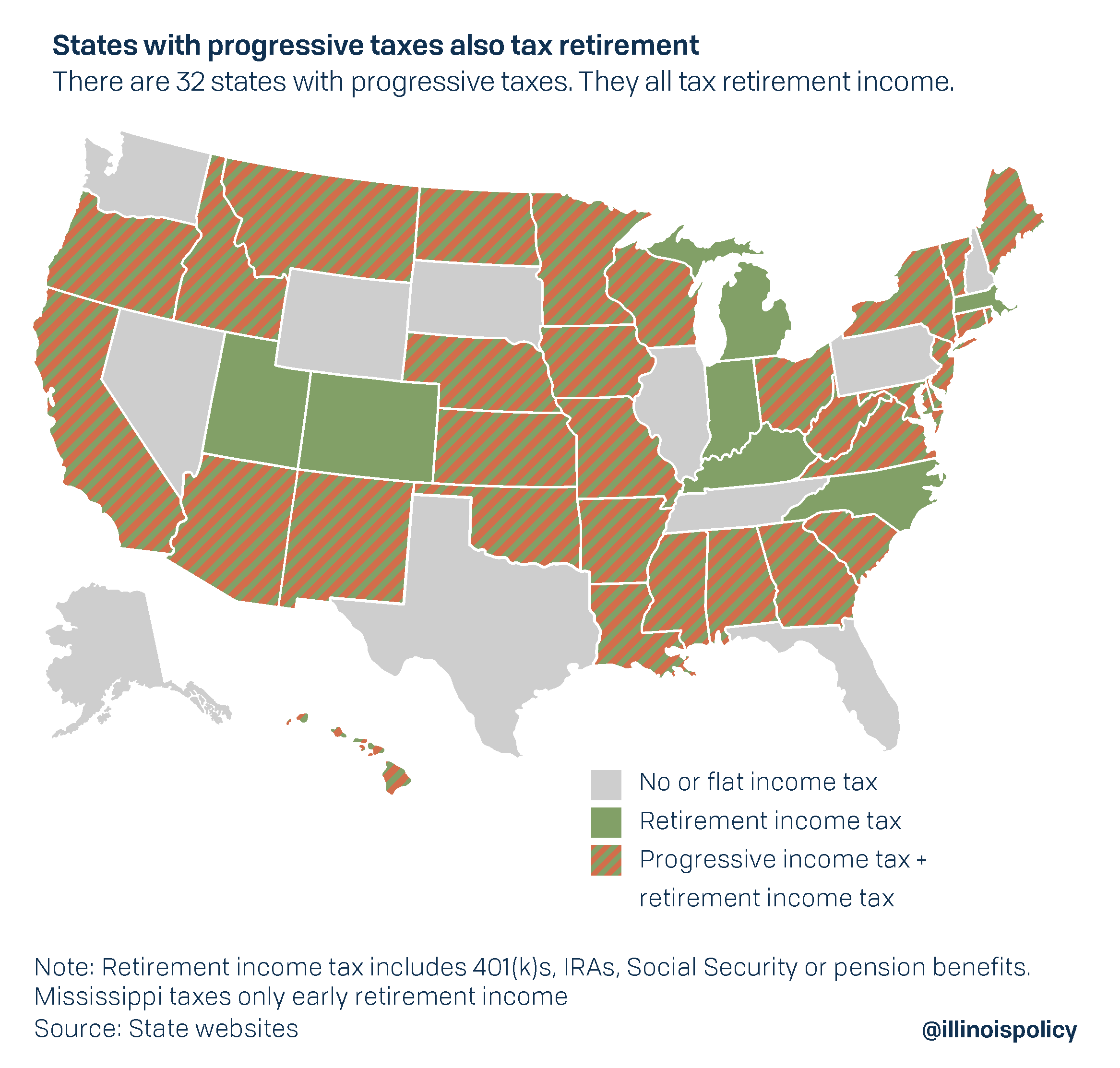

The state expects 95 of the payments to go out this year with the remaining checks reportedly arriving by Jan. There is no tax schedule for Mississippi income taxes. But since Mississippi does not require retirees to pay state income tax on qualified income the.

0 on the first 2000 of taxable income. These rates are the same for individuals and businesses. Section 27-31-1 to 27-53-33 All property real and personal is appraised at.

Box 23058 Jackson MS 39225-3058. The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses. The state does not tax Social Security benefits income from public or private pensions or withdrawals from retirement accounts.

Cre dit Card or E-Check Payments. How does Mississippis tax code compare. On top of that.

Pay by credit card or. The personal income tax which has a top rate of. If you do not pay your property taxes by the due date you could face a 5 penalty up to a maximum of 1000.

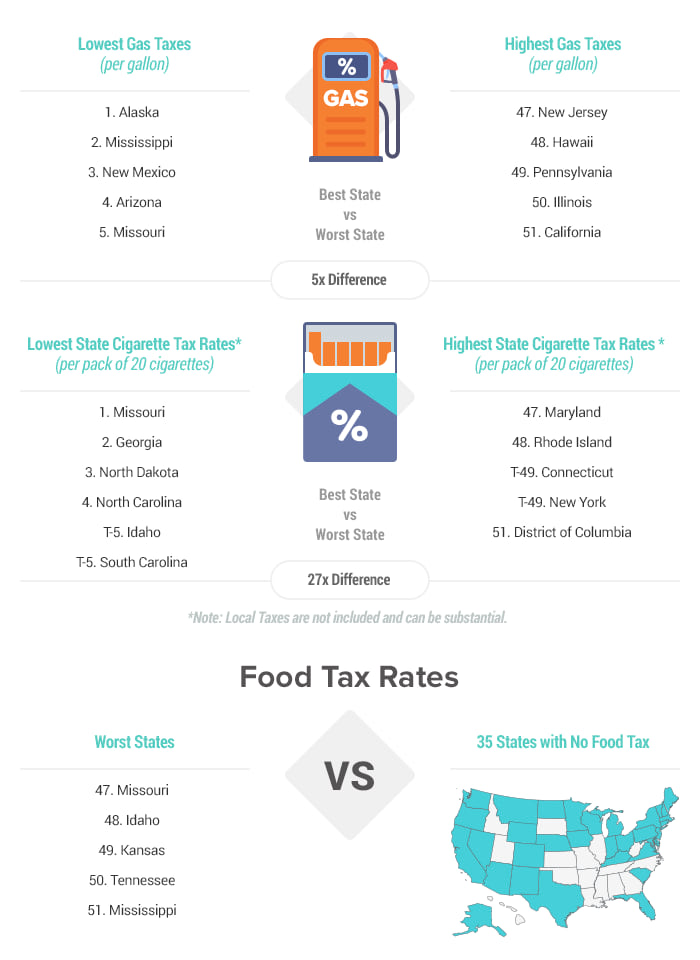

All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate. In 2020 the auditors office uncovered the largest public fraud case in state history and it involved TANF money. Overall state tax rates range from 0 to more than 13 as of 2021.

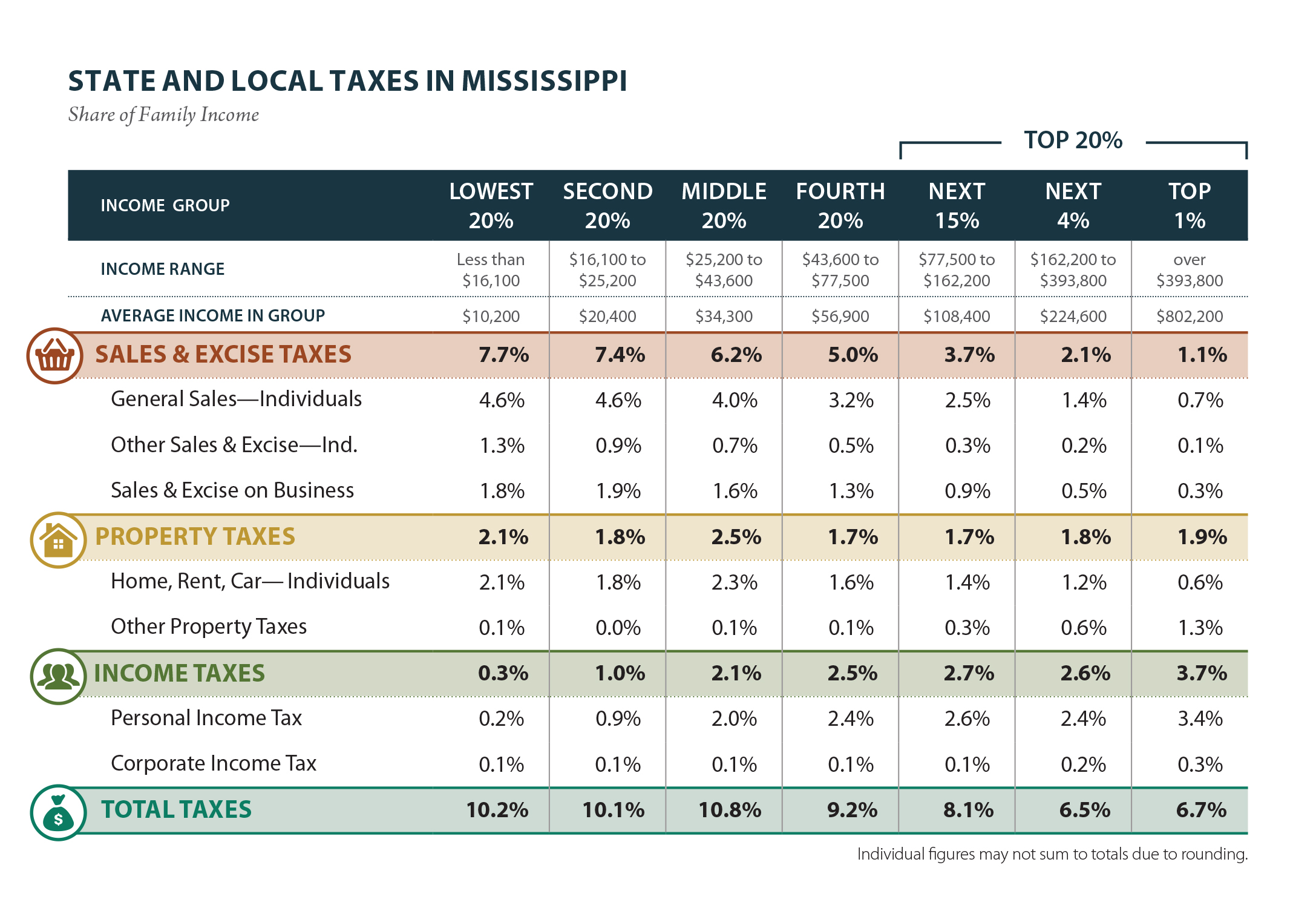

The Mississippi state government collects several types of taxes. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Mississippi has a graduated tax rate.

Mississippi is very tax-friendly for retirees. Form 89-105 Employers Withholding Tax Return due monthly quarterly seasonal or annual. If you fail to pay your taxes and the penalty within 30 days the.

Welcome to The Mississippi Department of Revenue. The state offers a homestead exemption for homeowners who are. Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals.

How much California residents will receive is based on their income. Mississippi exempts all forms of retirement income from taxation including Social Security benefits income from an IRA income from a 401k and any pension income. All other income tax returns P.

As of 2019 Mississippi is one of 35 states that offer some type of property tax relief for its senior citizens. Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent.

The investigation revealed for the first time that tens of millions. The most significant are its income and sales taxes. You can make electronic payments for all tax types in TAP even if you file a paper return.

Forms required to be filed for Mississippi payroll are. California Hawaii New York New Jersey and Oregon have some of the highest state income tax rates in. Unlike the Federal Income Tax Mississippis state income tax does not provide.

Mississippi also has a 400 to 500. Property Tax main page forms schedules millage rates county officials etc Ad Valorem Tax Miss. The tax rates are as follows.

Individual Income Tax FAQs. The following is intended to provide general information concerning a frequently asked question about taxes administered by the Mississippi Department of.

Mississippi Retirement Tax Friendliness Smartasset

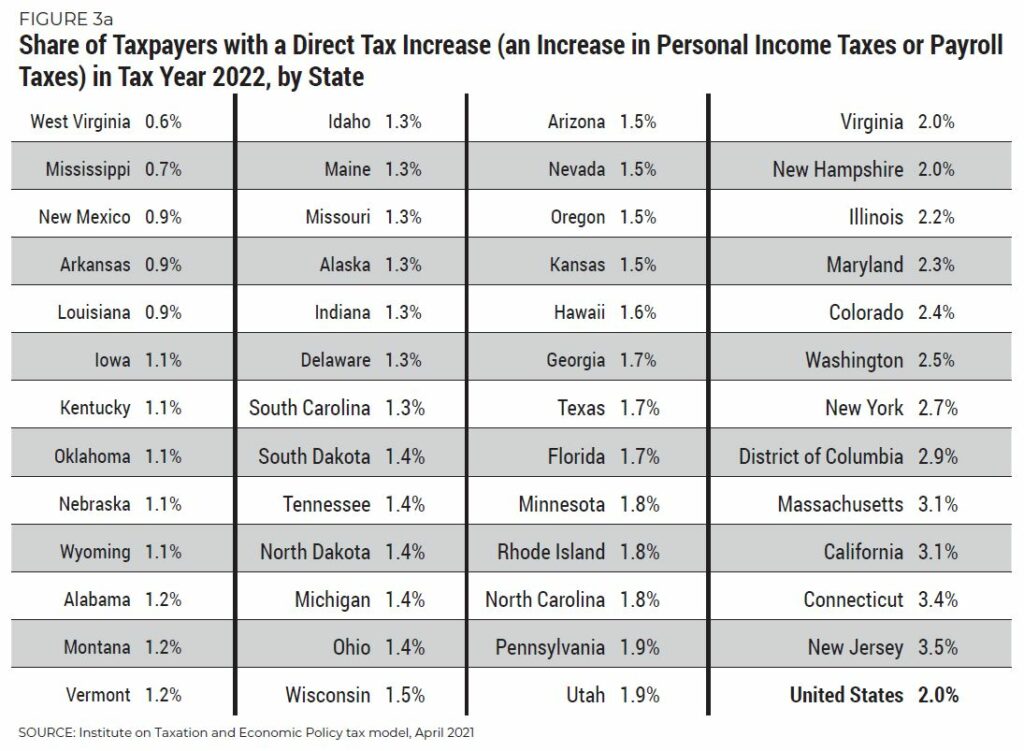

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

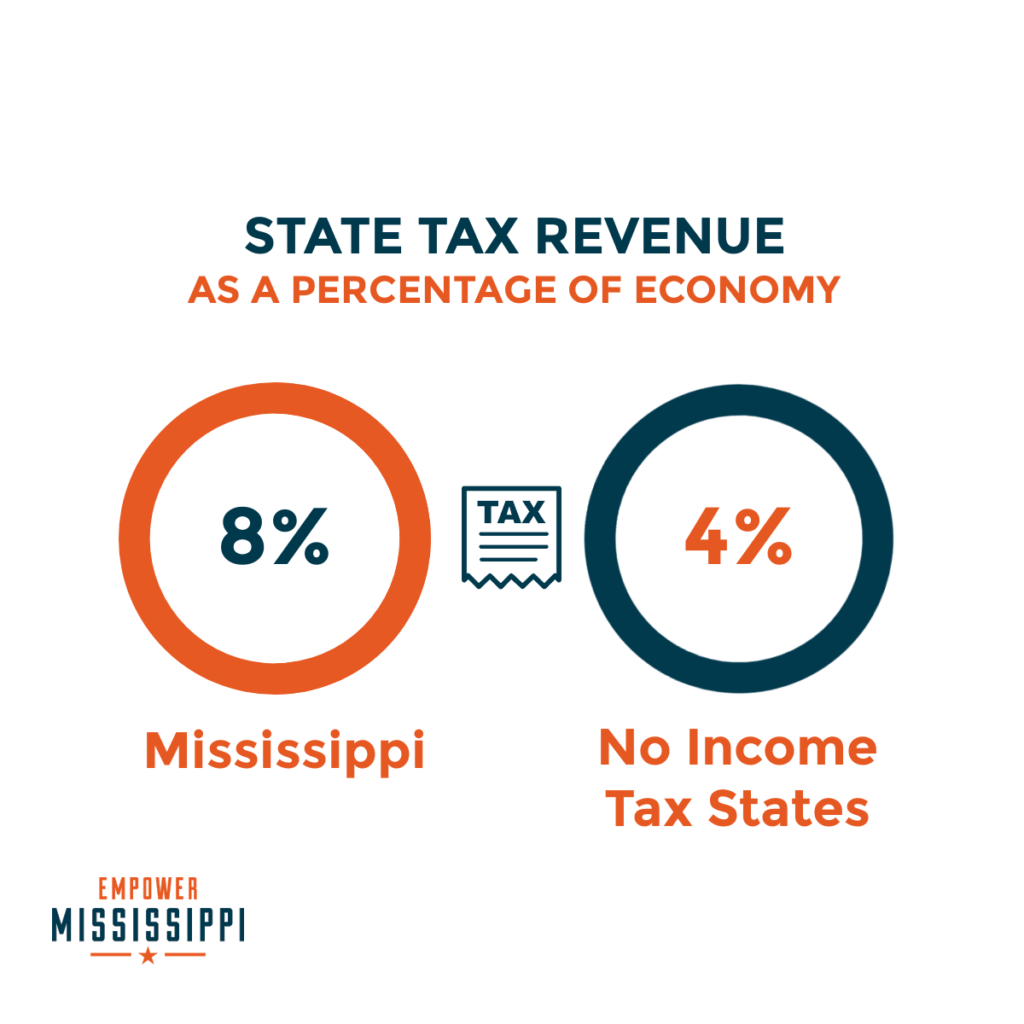

But How Will We Fund Government Without Income Taxes

Every State With A Progressive Tax Also Taxes Retirement Income

Mississippi Income Tax Calculator Smartasset

Ar Ms Tn Sales Tax Holidays What You Need To Know Localmemphis Com

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

How To Form An Llc In Mississippi Llc Filing Ms Swyft Filings

Mississippi State Income Tax Ms Tax Calculator Community Tax

Reeves In State Of The State Raise Teacher Pay Cut Taxes

File Ms Taxes With Dept Of Revenue E File Com

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi Who Pays 6th Edition Itep

But How Will We Fund Government Without Income Taxes

Tennessee Exempted Taxes On Food Mississippi Exempted Taxes On Guns Mississippi Today

Mississippi Retirement Taxes And Economic Factors To Consider

Mississippi Governor Raise Teacher Pay Cut Taxes Localmemphis Com